Portland’s downtown office space market is confronting a concerning reality: nearly a third of its office space lies vacant, presenting a bleak outlook for the city’s commercial property sector.

The downtown skyline, once bustling with activity, is now dotted with skyscrapers facing the challenges of too few tenants and loans that are nearing maturity without the possibility of refinancing, Willamette Week reported.

Referred to as “death lists” among real estate professionals, the documents outline properties that are economically unsustainable. These buildings are burdened by excessive debt and insufficient rental income to cover it. Phrases like “deed in lieu of foreclosure,” “expected to go back to the bank,” or being on a “watchlist” due to upcoming loan maturities populate these lists, painting a grim picture of the market’s condition, the outlet reported.

The vacancy crisis amplified by the pandemic has affected markets nationwide, but Portland seems to be facing it particularly acutely. Many buildings with loans secured during the last real estate boom, marked by low interest rates, are now reaching maturity. However, their value has diminished while interest rates have surged, creating an unfavorable environment for refinancing.

Experts note that Portland’s challenges extend beyond the pandemic’s impact. Plywood from 2020 protests still covers some downtown storefronts, and lingering homeless encampments add to the blight. The city’s downtown blocks face a mix of social issues, potentially deterring tenants and investors alike.

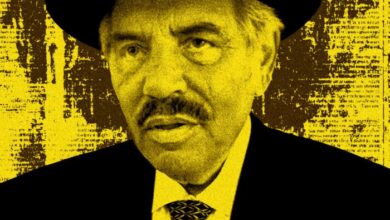

Bob Ames, a long-time investor in commercial property, said that the situation is dire, suggesting that major employers might stay away from Portland for years due to the prevailing conditions.

“I’ve been in this business for 50 years, and I’ve never seen anything like this,” Ames told the outlet.

Data from Colliers highlights that Portland’s office vacancy rate, including sublet space, reached 31.5 percent in Q2 2023 — higher than several other major U.S. cities, according to the outlet. Only San Francisco, with a 31.9 percent vacancy rate, was higher.

“The Portland office market continues to face a bleak outlook at the midway point of 2023,” analysts at Colliers wrote, according to the outlet. “Over the next two quarters, more than 500,000 square feet of leased space is set to expire marketwide. Should these tenants maintain office space following the expiration of their leases, they will likely look to downsize their real estate footprints.”

The impact on Portland’s tax revenue is another concern. Given that the city relies on income tax and property tax, decreasing property values could lead to reduced tax revenue for public services like schools and shelters.

As loans come due, owners are faced with the dilemma of refinancing in a less favorable market environment. The consequences are evident in the case of buildings like Montgomery Park, Commonwealth Building, and Aspect on Sixth, each facing their unique challenges, including reduced market value, foreclosures, and liens.

— Ted Glanzer

Source link