Photo-Illustration: Intelligencer; Photo: Getty Images

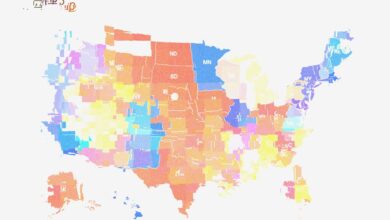

This summer has been an absolute bonanza for travel. At the Jersey Shore, crowds have gotten so large that beaches had to shut down. Yellowstone has had its second-best year through May since 2019, and while numbers aren’t available for all national parks, Glacier National Park in Montana has seen a similar rise. New York City expects 64.5 million tourists this summer, over 2 million more than last year. On just about any given day this year, far more people have been flying — about 142,874 more per day, on average, than last year, according to TSA check-in data. Even gas prices have been lower than they were in 2023, making it easier to take a long drive along America’s crumbling infrastructure.

But even with all these millions of people moving around, you’d think that Airbnb — primarily in the business of boarding travelers — would be doing great. You would be mistaken. On Wednesday, Wall Street punished Airbnb with its worst day in the market since it went public in December 2020, with the stock falling as much as 16 percent. Clearly, the Silicon Valley giant is not having a great summer — exactly when you think it would be. Here’s how it got here.

Scams, terrible listings, and abusive hosts have been some of the issues dogging Airbnb for years. But even if a rental turns out not to be a bait and switch, a sizable number of listings that don’t quite deliver on their promises — or just aren’t nice places to stay — have long strained the platform. The company has promised to address this for years, and it is evidently still a problem. During an investor call on Tuesday, CEO Brian Chesky acknowledged that it was still an issue the company was grappling with: “We’re removing low-quality supply,” he said, adding that the company has removed 200,000 rentals over the past 16 months.

This isn’t entirely Airbnb’s fault. At its core, Airbnb is a kind of social network and has the same kinds of problems that are going to hurt any kind of company that tries to bring in as vast a base of users as possible. While hotel chains can rely on corporate rules and standards, and a large workforce to maintain a level of quality, the Airbnb model is, essentially, to clean up messes after they happen.

During the company’s most recent earnings call, an analyst asked why Airbnb Rooms — a budget-conscious slice of the business that offers rooms inside people’s homes as cheaper places to stay — wasn’t growing faster. This is a good question. According to an April survey from Bankrate, 80 percent of travelers were looking to cut costs on their vacations this year after two years of inflation has made traveling considerably more expensive. (This business environment is why McDonald’s and Burger King lowered prices these past few months.)

But Chesky’s answer made it apparent that going down-market is not a priority. “It’s just a small percent of our business,” he said. “It’s very affordable. It’s very popular for Gen Z, but it is off a very small base. And so, you’re not going to see a major change to the growth rate of the company based on that.” To translate: The youngest and least-affluent travelers aren’t going to suddenly find good deals on Chesky’s app, because Airbnb has no real plans to grow that business.

Why? The company is happy to be pricey — since that’s how it makes its money. Airbnb’s various fees, which can sometimes double the cost of a stay, are by now a well-known aspect of using the platform. (Last year, the app rolled out a new way of showing pricing, since the advertised prices were, at best, misleading.) The more hosts charge, the more Airbnb makes. In addition to a 14 percent service fee, Airbnb takes a 3 percent cut on the listing plus any additional charges — including the cost of cleaning services and whatever else a host may tack on. The company argues that you’re paying for 24/7 support and all the other perks that come with an on-demand rental service. But this also feeds into another perception that has dogged Airbnb for years: It’s often just not a good deal.

In 2014, Jessica Pressler reported on the backlash that Airbnb was facing after barreling its way into the New York City marketplace. “The dumbest person in your building is passing out a set of keys to your front door!” was the graffiti scrawled over the company’s ads, she reported then. Last year, City Hall all but banned Airbnb, effectively cutting the company off from one of its most lucrative markets. It is far from the only city to do so.

In Barcelona, Airbnb has been blamed for skyrocketing rents, and a looming ban will soon prevent short-term stays there. (Locals have also been blasting tourists with water guns.) Berlin has tightly restricted them since 2018. Paris, too, has made it far harder to rent on the platform. (Airbnb’s advertising blitz during the Olympics is, in part, about winning back the local government.) Even San Francisco has limited rentals and made short-term rentals more expensive.

Airbnb has responded by looking elsewhere. Chesky told investors that Asia and Latin America are its fastest-growing regions. (Though, they would make far less renting homes there than in, say, the East Village.)

To help overcome some of these difficulties, the company spent more than $1 billion in marketing during the first half of the year, far more than it had in 2023. Chesky said he has no plans on slowing that down. (Perhaps you’ve seen ads for them during the Olympics.)

Wall Street is not a big fan of this idea. “Kicking up marketing spend at a moment when demand is softening tends to be the ultimate backbreaker for an internet stock in our experience,” an analyst at RBC wrote in a note. The key problem here is the concept of return on investment. While bookings rose during the last quarter, the sudden drop in Airbnb’s stock on Wednesday made it evident that they did not rise enough to justify how much the company was spending. In essence, its commercials have not been so convincing that more people are spending their time and money on the platform.

Airbnb was among the class of companies that, like Uber and MoviePass, got popular quickly in the 2010s because venture-capital firms were footing a portion of the bill, making their services too cheap not to use. Former New York columnist Kevin Roose dubbed that the era of the Millennial Lifestyle Subsidy, but those days are long gone. Since Airbnb went public in late 2020, investors have far less patience to sustain losses or unproven strategies, especially when the hotel business model has been working fine for centuries.

During his investor call, Chesky talked up a return of Airbnb’s “experiences” — a way to book tours and other things to do while renting — and a new network that would connect landlords with management companies. The company’s core problem, though, is that it is trying to squeeze more profit from a shrinking, and increasingly skeptical, base of affluent users, all while governments around the world move in tandem to blockade short-term rentals (and while the hotel industry has become savvier and more competitive). Maybe this will change during the end of the summer months, and travelers in August are inspired by the Olympics ads to see what’s on the platform. But Wall Street’s patience seems limited.