Photo-Illustration: Intelligencer; Photo: Getty Images

On July 16, the S&P 500 index, one of the most widely cited benchmarks in American capitalism, reached its highest-ever market value: $47 trillion. Of those 500 publicly traded companies, just seven of them made up a third of that valuation. To put it another way, 1.4 percent of those companies were worth more than $16 trillion, the greatest concentration of capital in the smallest number of companies in the history of the U.S. stock market.

The names are familiar: Microsoft, Apple, Amazon, Nvidia, Meta, Alphabet, and Tesla. They are all Silicon Valley, if not by address than by ethos. All of them, too, have made giant bets on artificial intelligence, hoping that the new technology will target better ads (in the case of Meta’s Facebook and Instagram), make robotaxis a possibility (as per Elon Musk), or, in the case of Nvidia, just make the chips that allow the technology to run in the first place. For all their similarities, these trillion-dollar-plus companies have been grouped together under a single banner: the Magnificent Seven.

In the past month, though, these giants of the U.S. economy have been faltering. On Friday, the Nasdaq, an index of 100 tech companies’ shares, had fallen more than 11 percent from its peak in early July, entering a technical correction, after the likes of Google and Meta revealed that their spending on AI technology had far exceeded Wall Street’s expectations. “This is an amazing about-face, like we’ve crashed into a brick wall,” Bill Stone, chief investment officer at Glenview Trust, told Bloomberg.

This rout has led to a collapse of $2.6 trillion in their market value — which, as one Twitter commenter pointed out, represents the entire market cap of Nvidia, which for a brief moment a couple of weeks ago was the most valuable private company in the world. There has been bad news all around. For example, Tesla’s new self-driving future seemed a lot like its old self-driving future — that is, a big promise that seems unlikely to come anytime soon, if at all. And Microsoft, which owns a large minority stake in OpenAI, reported that its AI cloud-computing business hadn’t grown as much as investors had expected.

This steep decline in the Magnificent Seven stocks might seem like a clear signal that Wall Street has already become disenchanted with AI, that the thesis it would revolutionize industries and create a massive productivity boom anytime soon may not be such a sure thing. And that is true — at least to a point.

Wall Street seems to be coming to grips with the fact that AI is the kind of industry that has great marketing already built into the name. It’s like saying you work in “cures” — sounds great, if it works. Clearly, ChatGPT shows that the technology is viable. But the worst scenarios, which involve mass layoffs and a sudden concentration of political power, have also not come to pass. AI hasn’t really replaced a significant number of jobs, and in the cases where it has, employers have ended up hiring people back anyway. (Let’s set aside the hyperbolic predictions around Matrix-like scenarios or superintelligent computers.) That has led to something of a vibe shift. It is commonplace now to denigrate something mediocre or sloppy as having been created by AI. Earlier this year, Goldman Sachs issued a deeply skeptical report on the industry, calling it too expensive, too clunky, and just simply not as useful as it has been chalked up to be. “There’s not a single thing that this is being used for that’s cost-effective at this point,” Jim Covello, an influential Goldman analyst, said on a company podcast.

AI is not going away, and it will surely become more sophisticated over the next few months, to say nothing of the long-term potential. This explains why, even with the tempering of the AI-investment thesis, these companies are still absolutely massive. When you talk with Silicon Valley CEOs, they love to roll their eyes at their East Coast skeptics. Banks, especially, are too cautious, too concerned with short-term goals, too myopic to imagine another world. So what if it’s not cost-effective? It’s the future!

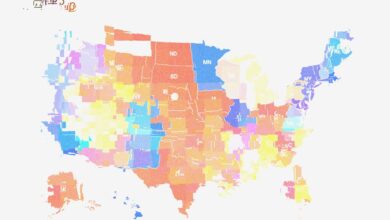

Be that as it may, public companies rely on public dollars, and Wall Street has taken an about-face on its winners-take-all strategy. Another index of smaller companies, the Russell 2000, has risen by more than 11 percent amid the Magnificent Seven’s rout. In terms of dollars and cents, that comes out to be about $300 billion, or less than 2 percent of the Magnificent Seven’s peak valuation. But it signals that there is something much bigger going on. This is a broad base of companies, like consumer brands including E.l.f. Beauty and Abercrombie & Fitch, which simply don’t have as much capital to do anything effective with AI or where the technology is beside the point.

Look — nobody is going to invest in a company just because it doesn’t use AI. Wall Street has not gone Luddite all of a sudden. What’s happening here comes down to what Covello was talking about: the boring but necessary work of deciding what is cost-effective.

Update: this story was updated to add Friday’s deeper sell-off of tech companies.

Source link